Hello everyone! It has been a while but we can assure you that we are back and better!

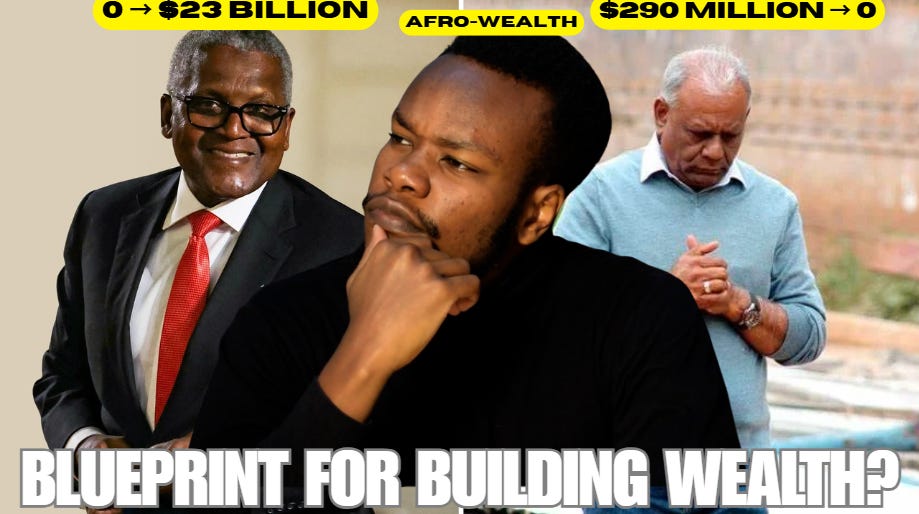

In this next installment of our impactful journey, we dive deep into The Psychology of Money—and this time, it’s personal. Join Max and Nia, our custom AI chatbot from The Impactful Capitalists, as they explore the real reasons why some people quietly build wealth while others lose it all, especially in the African context. This conversation unpacks the emotional and cultural forces that shape how we earn, save, and invest. If you’ve ever wondered why money feels so hard to manage—or what it really takes to stay wealthy in Africa—this one’s for you. So grab your headphones, settle in, and enjoy the ride.

Here are the video chapters:

00:00. Some highlights from our conversation

01:46. Welcome back to the upgraded podcast!

03:43. How Morgan Housel redefines wealth in 'The Psychology of Money'

08:09. How better habits can lead to more wealth, long-term

15:05. Do better habits mean you can't take any risks?

20:31. How our biases affect how we view money

23:15. Why it is so hard to build and preserve wealth in Africa

32:28. How Africa's best wealth builders have built and preserved wealth

37:40. Surprise that helps everyone on their personal finance journey!

Click here or on the image below to watch the full video on YouTube!

Ready to Discover Your Investor Profile?

To make all this more actionable and fun, we invite you to take the next steps with us:

Click to take the Investment Personality Quiz – a short, interactive quiz to help pinpoint your risk tolerance, interests, and style. Are you a cautious saver, a balanced planner, or a go-getter investor? The quiz will tell you, and suggest which options might resonate most with your persona.

Click to explore the Investment Compass (Kenya Edition) – an interactive tool where you can input your goals (like “buy a car in 3 years” or “educate kids in 10 years” or “retire at 60 with X income”) and it will map out a possible mix of investments tailored to you, along with local examples. It’s like getting a mini-financial plan specifically for the Kenyan context.

Click to watch Our Behind-the-Scenes Video – join our team in a candid video where we each took the quiz and discovered our own investment personalities! It’s a fun, relatable way to see these concepts in action and how even we, as financial educators, balance our choices. Plus, you’ll get a laugh or two and plenty of inspiration as we build strategies that reflect our unique lives.

Click to download a free copy of our official e-book: “Building Wealth in Kenya: A Guide to Investment Options” - an engaging and easy-to-understand exploration of the most popular investment options in Kenya, including T-bills, bonds, money market funds, SACCOs, real estate, stocks, and more. The book walks you through where your money actually goes, the risks and rewards involved, how long you should plan to invest, and who each option is best suited for. Whether you're just starting or looking to grow smarter, this guide will help you make informed, confident decisions about your financial future.

Thank you for spending your time with us…

and being part of this growing community of curious, forward-thinking individuals who are determined to build a better financial future—for themselves, their families, and the generations to come. Your journey toward clarity, confidence, and impact in your money decisions is one we’re honored to walk with you. We hope today’s insights spark conversations, shift perspectives, and inspire real action.

Until next time, keep it impactful.

Max

Share this post